Double top pattern

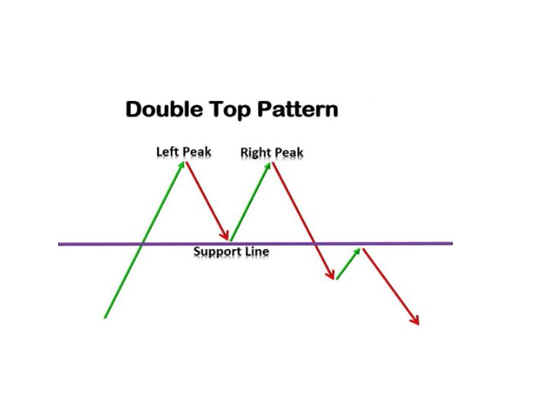

A double-top pattern is a technical analysis pattern that forms when the price of an asset creates two consecutive peaks of approximately the same height, with a trough in between. This pattern is formed by drawing a neckline, which connects the lows of the price between the two peaks. The double top pattern indicates a potential trend reversal from bullish to bearish.

Here are some ways that traders use double-top patterns in their trading strategies:

Identifying potential trend reversals: Traders can use double-top patterns to identify potential trend reversals from bullish to bearish. When the price breaks below the neckline, it can be a strong indication that the asset's price is likely to decrease further. Traders can sell the asset when the price breaks below the neckline.

Setting profit targets: Traders can use the height of the double top pattern to estimate the potential price target of the trend reversal. The estimated price target is measured by subtracting the height of the pattern from the neckline. Traders can use this target to set their profit target for their short position.

Setting stop-loss levels: Traders can use double top patterns to set stop-loss levels to limit their potential losses. If the price breaks above the neckline, it can be an indication that the pattern has failed and that the trend may continue. Traders can set their stop-loss orders just above the neckline to minimize their potential losses.

Using additional indicators: Traders can use additional technical indicators in combination with double-top patterns to confirm their trading signals. For example, traders may use momentum indicators or volume indicators to confirm bearish conditions when the price breaks below the neckline.

In conclusion, double-top patterns can be a useful tool in a trader's technical analysis toolkit for identifying potential trend reversals, setting profit targets, and setting stop-loss levels. However, traders should combine this pattern with additional technical indicators and perform thorough analysis before making any trading decisions. As always, it's important to manage your risk and use appropriate position sizing to control your potential losses.