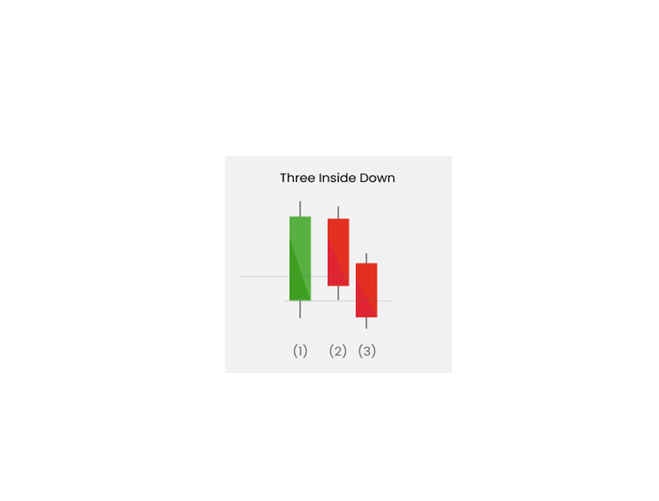

Three Inside Down Pattern

The Three Inside Down pattern is a bearish reversal pattern that consists of three candles. The pattern typically occurs after an uptrend and suggests that the trend may be reversing to the downside.

On the first day of the pattern, a long white candle appears, indicating bullish sentiment. On the second day, a black candle appears, which is smaller than the previous white candle and is entirely contained within its range. This suggests that the bulls are losing strength and the bears are starting to gain control.

On the third day, a black candle appears that closes below the low of the second day, confirming the bearish reversal. This third candle suggests that the bears have gained control and are likely to push the price further down.

Overall, the Three Inside Down pattern suggests a shift in market sentiment from bullish to bearish and is used by traders to identify potential short-selling opportunities. Traders often wait for confirmation of the pattern before entering a trade, such as a bearish candle closing below the low of the second day.