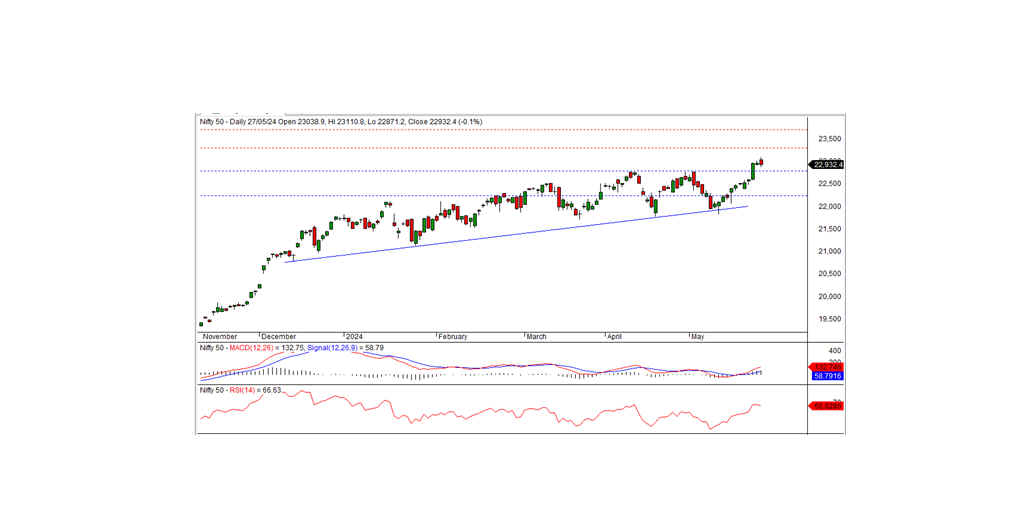

NIFTY Technical Outlook

Based on Market Closing on Monday, May 27, 2024

In the last trading session, the Nifty closed at 22,932.45, down 24.65 points or 0.11%. The downtrend is expected to continue if the index moves below the intraday support level of 22,900.

The Nifty opened at 23,038.90 on a positive note and reached a record high of 23,110.90 during morning trade. However, the index could not maintain this momentum, falling to an intraday low of 22,871.20, and eventually closing at 22,932.45. Sector-wise, banks, realty, financial services, and IT were the top gainers, while media, metal, FMCG, and auto were the biggest losers. Market breadth was negative, with 913 stocks rising, 1,554 falling, and 139 remaining unchanged. The top gainers in the Nifty were DIVISLAB, INDUSINDBK, AXISBANK, and ADANIPORTS, while the major losers included ADANIENT, WIPRO, GRASIM, and ONGC.

From a technical standpoint, the Nifty remains above both the short-term and long-term moving averages. Momentum indicators signal a positive trend. However, the index formed a black candle on the daily chart and closed below the previous day's close, indicating a slightly negative bias. On the downside, the Nifty has intraday support at the 22,900 level, while the nearest intraday resistance is at 23,030. The negative bias will persist if the index trades and sustains below the 22,900 support level. For a pullback rally, the index needs to surpass the 23,030 resistance.

Intraday Levels: Support: 22,900, 22,800, 22,700 Resistance: 23,030, 23,150-23,250 (15-Minute Charts)

Positional Trading: Short-term support: 22,800-22,250 Resistance: 23,300-23,700

Bank Nifty Technical Outlook

In the preceding trading session, Bank Nifty closed at 49,281.80, registering a gain of 310.15 points. Technically, momentum indicators signal a positive trend, and the index remains above both short-term and long-term moving averages. Additionally, the index formed a white candle on the daily chart and closed above the previous day's close, indicating a potential continuation of the uptrend.

On the higher side, the index has short-term resistance at the 49,500 level. If the index closes above this level, the positive trend is likely to continue in the coming days. The nearest intraday support is at the 49,050 level.

Intraday Levels: Support: 49,050, 48,750, 48,500 Resistance: 49,300, 49,650, 49,950 (15-Minute Charts)

Positional Trading: Short-term support: 48,250-47,000 Resistance: 49,500-50,600