White Marubozu Candlestick Pattern

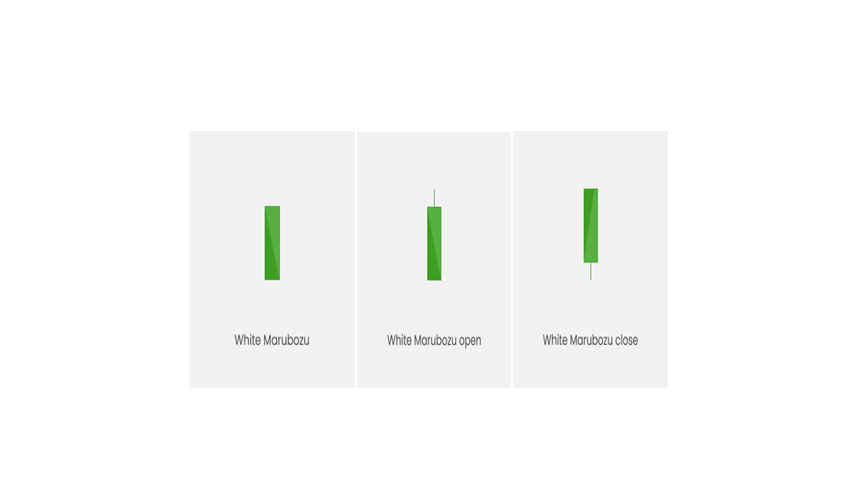

There are three types of White Marubozu:

White Marubozu is a type of candlestick pattern that appears on a chart, indicating a bullish trend in the market. The term "Marubozu" is derived from the Japanese word "marubozu," which means "shaved" or "bald." This pattern is characterized by a long white candlestick with no upper or lower shadows. The opening price is equal to the lowest price of the day, and the closing price is equal to the highest price of the day.

A White Marubozu suggests that buyers have been in control throughout the entire trading session, driving the stock or asset price higher. This is an indication of a strong buying momentum and bullish sentiment. If the pattern appears after a downtrend, it may signal a potential trend reversal to an uptrend.

A white opening Marubozu is a type of candlestick pattern in technical analysis. It is formed when the opening price of a stock or security is the same as the low of the day, while the high and the closing price are significantly higher than the opening price. This pattern indicates that the buyers have been in control throughout the trading session, pushing the price higher with little to no resistance from the sellers. The absence of a lower shadow indicates that there was no selling pressure during the trading session. The small upper shadow may indicate some profit booking or selling pressure at the high of the day, but it was not significant enough to reverse the bullish sentiment. This pattern is considered a bullish sign and suggests that the uptrend may continue in the coming days. Traders may use this pattern to initiate long positions or add to existing ones.

A White-closing Marubozu is a bullish candlestick pattern that is formed when the closing price is equal to its high price and with a small lower shadow. This means that there is no upper shadow and a small or no lower shadow on the candlestick.

The absence of the upper shadow in the candlestick indicates that the buyers had complete control over the price movement of the stock or asset throughout the trading session. The small lower shadow shows that the sellers didn't have enough strength to push the price below the opening price.

The White-closing Marubozu is often interpreted as a strong bullish signal by traders and investors, as it suggests that the bullish trend is likely to continue in the near future. This pattern may indicate a high level of buying interest in the stock or asset, and traders may look to enter long positions or add to their existing positions. However, as with any candlestick pattern, traders should always consider other technical indicators and market conditions before making any trading decisions.