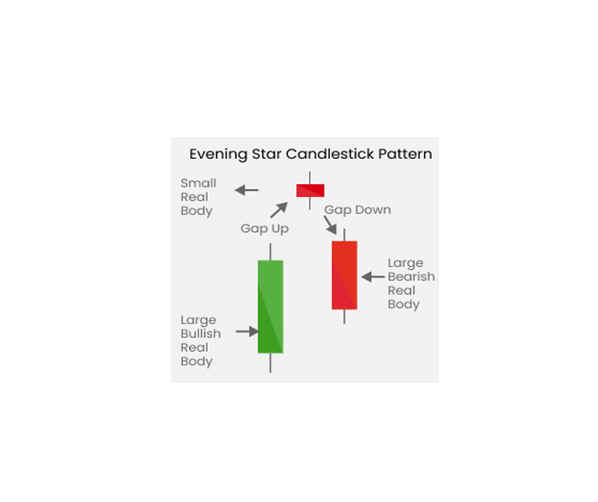

Evening Star candlestick pattern

The Evening Star pattern is the opposite of the Morning Star and is viewed as a bearish reversal pattern that typically occurs at the top of an uptrend. This pattern is comprised of three candlesticks: a large white candle on the first day, a small white or black candle on the second day, and a long black candle on the third day.

The first part of the Evening Star reversal pattern is the large white candle, which signifies the existing uptrend. The second day begins with a bullish gap-up, indicating that buyers are in control. However, the buyers are unable to push the prices significantly higher. On the second day, the candlestick can be bullish, bearish, or neutral, depending on market conditions.

Day three begins with a downward gap, and the sellers are able to drop the prices even further downward, often eliminating the gains seen on day one. This strong downward momentum on the third day further confirms the bearish reversal pattern of the Evening Star.

It is important to remember that the Evening Star pattern is just one factor to consider when making trading decisions. Traders and investors should always analyze other technical indicators and market conditions before entering into any trades.